All monthly subscriptions have a minimum initial period of 18 months and 12 months thereafter.

SUBSCRIBE

- A daily email providing you with a summary of that last seven days of regulator and sanction updates from more than 30 jurisdictions (over 50 regulators and 000’s of lists) at 10.30pm everyday GMT direct to your inbox covering:

- Regulator notifications Dated emails/RSS notifications (where regulator provided)

- Summary of list updates Added, changed, deleted

- The email also links to a secure Free WebApp, that provides more details on changes such as:

- 7 days of updates By jurisdiction, regulator, and list

- Summary details Of records added, deleted, or updated

- Single point of access to all the data from all the monitored regulators

SUBSCRIBE

Paid Monthly

- $600 per user per month

Annual Subscription (One Initial Payment)

- $6,000.00 per year ($500.00 per month)

Hosting & Support per month

- No Hosting & Support Cost

- As Free PLUS

- 30-day tracking of updatesby jurisdiction, regulator, focus and list

- Detailed types of change of each record whether a name, address, identifier or details

- Profile records from multiple sources consolidated where records cross reference

- Sanctions map of who sanctions who and where the sanctioned are.

- Analytics on changes, updates per monitor and changes over time.

- No code, no implementation service Add your Dow Jones, Refinitiv, Moody’s or LexisNexis regulator lists and your own internal versions of screening lists and monitor updates from each list and each data feed

- Plug and play, simply sign up and send a file or provide licence key and you’re up and running

- Manual download to CSV of profiles (upto 1,000 per CSV max 10,000 per month).

SUBSCRIBE

Paid Monthly

- $1500 per user per month

Annual Subscription (One Initial Payment)

- $9,000.00 per year ($750.00 per month)

Hosting & Support per month

- No Hosting & Support Cost

- As Monitoring plus

- Add your Dow Jones, Refinitiv, Moody’s or Lexis Nexis data and automate:

- End to end reconciliation of sanctions from regulator legislation to aggregator

- Track when new listing, changes, delisting updates were published and when they were applied to your screening platform

- Have the security of a detailed audit trail of all events

- Set filters to view the changes you are interested in

- Real-time latency and reconciliation reports - management summary, latency, provider change tracking exception-based alerts

- Continuous baseline assessments and GAP analysis of every list, record, field and value to ensure you’re covered, identify missing values and manage changes to list structures as they occur.

REGISTRATION

- Single User

- Website access only

- Access to regulatory data sets at source

- Updates of changes to sanction lists

SUBSCRIPTION

- Single User

Set Up

- No Set Up Cost

Connect (Optional)

- Connect available on request

Hosting & Support per month

- No Hosting & Support Cost

Annual

- $15,000 per year

Downloads and Connect

- Manual download to CSV

- Upto 1,000 records per CSV

- 10,000 records per month

SUBSCRIPTION

- 5 User pack

Set Up

- No Set Up Cost

Connect (Optional)

- Connect available on request

Hosting & Support per month

- No Hosting & Support Cost

Annual

- $60,000.00 per year

Downloads and Connect

- Manual download to CSV

- Upto 1,000 records per CSV

- 50,000 records per month

- Connect API, XML, CSV or JSON

- Each additional record over 50,000 @2c per record

SUBSCRIPTION

- Unlimited from 15 users (no max)

Set Up

- No Set Up Cost

Connect (Optional)

- Connect Included

Annual Subscription (Monthly Debit)

- $270,000.00 per year

Annual Subscription (One Initial Payment)

- $225,000.00 per year ($18,750.00 per month)

Hosting & Support per month

- No Hosting & Support Cost

Downloads and Connect

- Manual download to CSV

- Upto 1,000 records per CSV

- 500,000 records per month

- Connect API, XML, CSV or JSON

- Each additional record over 500,000 @2c per record

SUBSCRIPTION

- Unlimited users (no max)

Set Up

- $10,000.00 Set Up Fee

Connect (Optional)

- Connect Included

Annual Subscription (Monthly Debit)

- Not available

Annual Subscription (One Initial Payment)

- $235,000.00 per year ($18,750.00 per month)

Hosting & Support per month

- Hosting & Support $7,500 per month($90,00.00 per year)

Downloads and Connect

- Manual download to CSV

- Upto 1,000 records per CSV

- 500,000 records per month

- Connect API, XML, CSV or JSON

- Each additional record over 500,000 @2c per record

SUBSCRIPTION

- Unlimited users (no max)

Set Up

- $40,000.00 Set Up Fee

Connect (Optional)

- Connect Included

Annual Subscription (Monthly Debit)

- Not available

Annual Subscription (One Initial Payment)

- $265,000.00 per year ($18,750.00 per month)

Hosting & Support per month

- Hosting & Support $3,400 per month ($45,000.00 per year)

Downloads and Connect

- Manual download to CSV

- Unlimited records per CSV

- Unlimited records per month

- Connect API, XML, CSV or JSON

ADD ON

Set Up

- $10,000.00 Set Up Fee ($50,000.00 max)

Annual

- $10,000.00 per year

- No code, content ready connectors that integrate sanctions data to screening platforms – reducing time, risk and cost by delivering data configured to your platform requirements

- Pre-screening data cleansing and standardisation - simplifies systems tuning, reduce data ‘noise’ creating false positives and accelerates implementations

- Consolidate of multiple datafeeds into a standard model to provide bespoke and enriched connectors to your specific sanctions, related people and entities (ownership and control), adverse media and PEP - delivering structured information from notes, inferences and comments you can action

- Distribute, enhance, integrate or migrate your Dow Jones/Refinitiv/Moody’s/ LexisNexis datafeeds across multiple platforms with real-time monitoring, reconciliation and issue alerts

Monitor

- Daily email summary of the last 7 days of regulator and sanction updates

- Coverage of over 50 regulators across more than 30 jurisdictions

- Email delivered at 10:30 PM GMT daily

- Details on: Regulator notifications (including dated emails/RSS feeds) Summary of list updates (added, changed, deleted)

- Link to a secure Free WebApp with: 7 days of updates by jurisdiction, regulator, and list Summary details of records added, deleted, or updated Single point of access to all monitored regulators’ data

Reconcile

- Integration with Dow Jones, Refinitiv, Moody’s, or Lexis Nexis data for automated reconciliation

- End-to-end tracking of sanctions from regulator legislation to aggregator

- Monitoring of new listings, changes, and delistings, with detailed audit trails

- Set thresholds for changes with full event audit trails

- Real-time latency and reconciliation reports, including management summaries and exception-based alerts

- Continuous baseline assessments and GAP analysis for every list, record, field, and value

Connect

- No-code, content-ready connectors to integrate sanctions data with screening platforms

- Pre-screening data cleansing and standardisation to reduce false positives and simplify tuning

- Consolidation of multiple data feeds into a standard model with enriched, bespoke connectors

- Distribution, enhancement, integration, or migration of Dow Jones/Refinitiv/Moody’s/Lexis Nexis data feeds across platforms

- Real-time monitoring, reconciliation, and issue alerts

Why Monitor

- Simplify monitoring across multiple regulators with different formats and communication methods

- Reduce the need for manual tracking for each regulator

- Easily keep up with rapidly growing and changing sanctions lists

- Eliminate the need to manually identify changes in daily sanction lists

- Reduce the time, cost, and risk associated with poor-quality lists and manual processes

- Ensure timely updates, crucial for screening clients and their business associates

- Automated monitoring, reports, and audit trails support existing compliance processes

Why Reconcile

- Bring uniformity to diverse regulatory data

- Ensure authenticity by tracking every change, timestamp, and action from publication to application

- Access precise, noise-reduced tracking that focuses on actionable updates

- Automate end-to-end tracking, reducing reliance on manual or script-based checks

- A hosted, managed service that simplifies the reconciliation process, ensuring you are always up to date with your screening data

Why Connect

- Simplify and accelerate integration of partner data feeds into screening platforms, reducing time, cost, and complexity

- Minimize maintenance effort by handling ongoing changes in data and platform requirements

- Ensure continuous data quality, correct updates, and resolution of data conflicts

- Plug-and-play, no-code connectors for rapid and low-risk platform migration or upgrades

- Access data in multiple formats that align with platform specifications, ensuring Dow Jones data integrity

Why Monitor for Dow Jones

- Integrates Dow Jones data and models at the core of a firm's risk and compliance screening processes

- Provides a real-time dashboard showing what changes, when, and by whom, highlighting the value of Dow Jones’ curated approach based on legislation

- Enhances competitive advantage by allowing clients to add their own feeds and integrators for comprehensive monitoring

- Increases service ‘stickiness’ by locking out competition and ensuring consistent reliance on Dow Jones data

Why Reconcile for Dow Jones

- Embeds Dow Jones data at the core of the firm’s compliance processes with end-to-end tracking from legislation to electronic lists to screening platforms

- Enables rapid adoption with a no-code, no-development integration, minimizing overhead for both Dow Jones and the client

- Visually deconstructs Dow Jones data versus regulator data versus internal interpretations, offering a clear common end state

- Simplifies understanding and accelerates adoption with continual gap analysis and baseline assessments, allowing for quick fixes and seamless deployment

- Provides a transparent, user-friendly process designed for businesspeople to make decisions and implement them without lengthy projects or timelines

- Transforms a compliance cost into a revenue stream, accelerating income realisation from new business

Why Connect for Dow Jones

- Adds a no-code, pre-integrated connector with minimal configuration time, allowing quick setup with Dow Jones data

- Utilises a single data model for easy platform switching, with impact assessments to ensure data consistency and effective screening

- Enables pre-screening data cleaning to align Dow Jones data with platform-specific standards, ensuring seamless migration

- Provides data in multiple formats and structures that match platform specifications while preserving Dow Jones data integrity

- Offers no-code, UI-based configurations for direct integration of Dow Jones data into screening platforms, securing Dow Jones as the primary data source and reducing competition

- Supports new business opportunities, platform upgrades, and the extension of new products with streamlined integration

How is alignVu available?

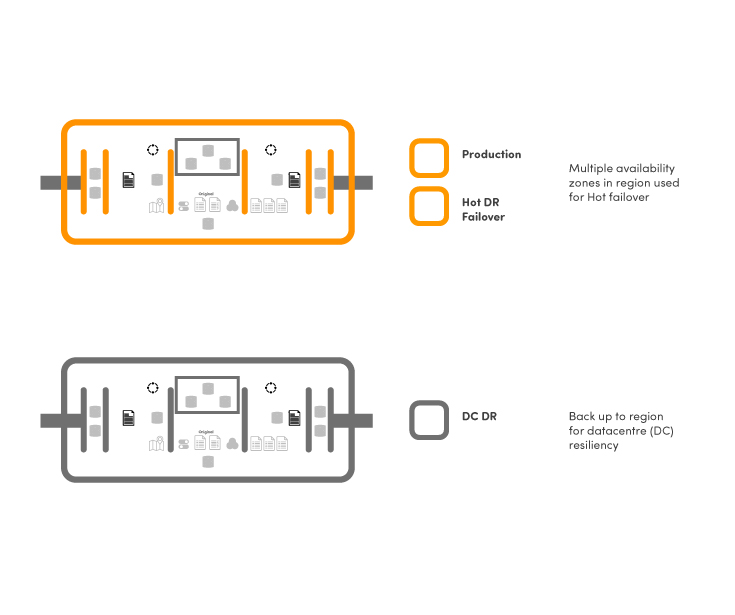

alignVu Cloud

- AWS Regional Datacenters

- Multiple Resilience, Backup and RD built-in

- Shared infrastructure for external datafeeds

- Encrypted data and client specific security

- Multiple dev, test, production environments

- Service Support and Performance Management

- Multi-factor authentications access

Dedicated Cloud

- AWS Regional Datacenters

- Multiple Resilience, Backup and RD built-in

- Shared infrastructure for external datafeeds

- Encrypted data and client specific security

- Multiple dev, test, production environments

- Service Support and Performance Management

- Multi-factor authentications access

Your Cloud or on Prem

- Supported as dedicated cloud

- Standard subscription

Security and Compliance at alignVu

alignVu takes compliance seriously and understands its significance to both customers and partners. For this reason, alignVu services have ensured certification compliance with the AICPA’s SOC for Service Organizations, SOC 2 Type II and GDPR – as set out in the Trust Services Criteria are noted below are guidelines and our own documentation support greater detail on all aspects including controls

The system is protected against unauthorized access (both physical and logical) as detailed in our operational policy manuals for AWS

Security

The system is available for operation and use as committed or agreed in line with the contracted up-time SLA. Report for Audit and controls are available on request.

Availability

System processing is complete, accurate, and authorized as clarified by the test authorisation and approval. All data that is transferred is verified and securely transferred using dedicated, encrypted HTTPS or encrypted SFTP process – both data in transit and data at rest.

Processing Integrity

Information that is designated “confidential” is protected according to policy or agreement as agreed under alignVu’s own information security processes which are GDPR compliant and default policy.

Confidentiality

Personal information is collected, used, retained, disclosed, and disposed of in conformity with the commitments in the entity’s privacy notice and with criteria set forth in Generally Accepted Privacy Principles issued by the AICPA in addition to rules defined and adhered to under GDPR

Privacy

User Account and Product Access Control Authentication Resources

Two factor authentication (2FA)

SSO SAML integration with external identity providers (separate URL) with optional whitelisting for added security

Data Encryption

alignVu uses 256-bit AES encryption at rest in addition to securing network communication with TLS 1.2 under https for encrypting data in transit.

Peer code reviews: every pull request is reviewed by peers, whether it’s a new feature or bug fix. Security reviews are performed as appropriate for the work.

Regular code audits for security.

Continuous integration and delivery: we use GitLab for our CI tooling. Every PR that is merged is automatically subjected to a pipeline of rigorous tests and analysis as appropriate for the code that is being merged.

Robust unit testing.

Regular penetration testing.

Threat Detection

alignVu has enabled threat detection software and enforces continual threat modelling exercises to identify and plan for any vulnerabilities in our environment.

Threat Detection

alignVu undergoes an external penetration test by an independent third party on an annual cadence, at minimum.

alignVu utilises Amazon Web Services (AWS) as its cloud service provider and leverages AWS’ security and compliance controls for data centre physical security and cloud infrastructure. Further resources for this service provider can be found on the AWS Security Cloud website

The IT infrastructure that AWS provides to its customers is designed and managed in alignment with best security practices and a variety of IT security standards. The following is a partial list of assurance programs with which AWS complies:

SOC 1/ISAE 3402, SOC 2, SOC 3

FISMA, DIACAP, and FedRAMP

PCI DSS Level 1

ISO 9001, ISO 27001, ISO 27017, ISO 27018

Benefits of AWS

Keep Your Data Safe: The AWS infrastructure puts strong safeguards in place to help protect your privacy. All data is stored in highly secure AWS data centres.

Meet Compliance Requirements: AWS manages dozens of compliance programs in its infrastructure. This means that segments of your compliance have already been completed.

Availability

alignVu has distributed SRE and Security teams that are on-call 24/7.

Logging

alignVu maintains a comprehensive log of all user and process activities. Each process activities are extensively logged internally for troubleshooting and support,and presented in summary in process History to inform users directly.

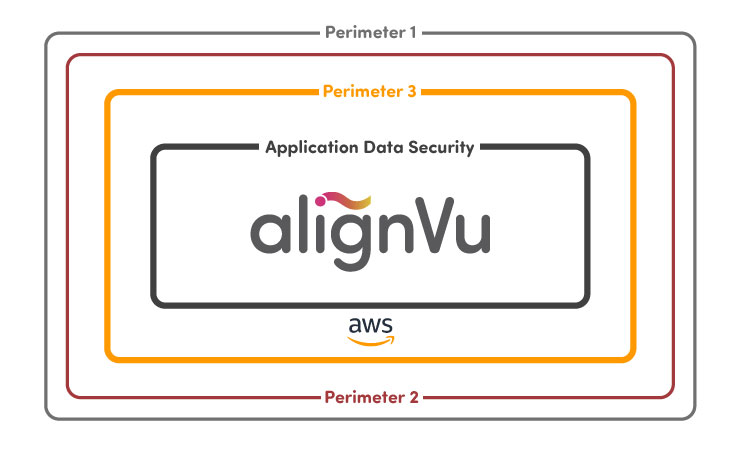

alignVu on AWS

Perimeter 1

- Whitelisted IP/URL access

- Dedicated client domain

- Public/private key for client dedicated SFTP 256-bit AES encryption at rest in addition to securing network communication with TLS 1.2 under https for encrypting data in transit

- Web applications Product Access Control Authentication Resources

- Two factor authentication (2FA)

- SSO SAML integration with external identity providers (separate URL) with optional whitelisting for added security

- All external facing assets sit in DMZ from data repositories

Perimeter 2

- AWS WAF

- AWS Shield

- AWS Firewall Manager

Perimeter 3

All servers and services built with Amazon EFS embedded using Advanced Encryption Standard algorithm with XTS Mode and a 256-bit key (XTS-AES-256)

Application Data Security

- Data encapsulated and accessible only through applications

- Each data element is tagged to owner and account/user account security applied

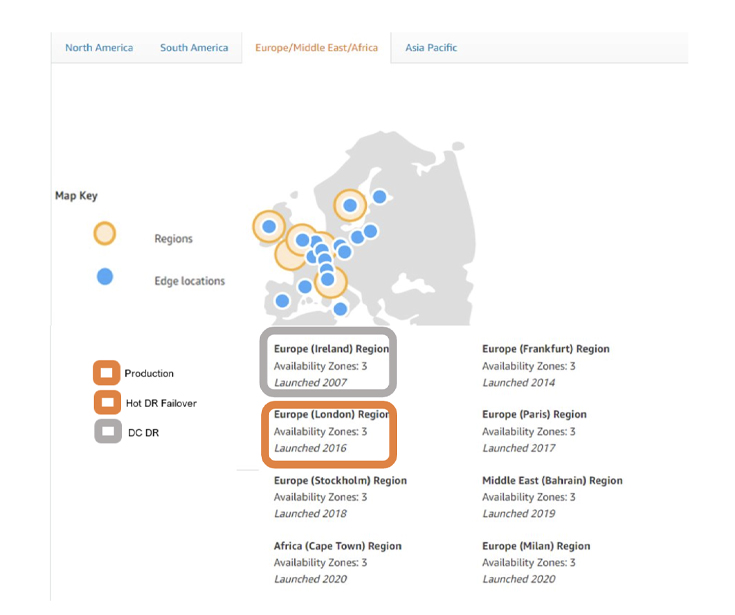

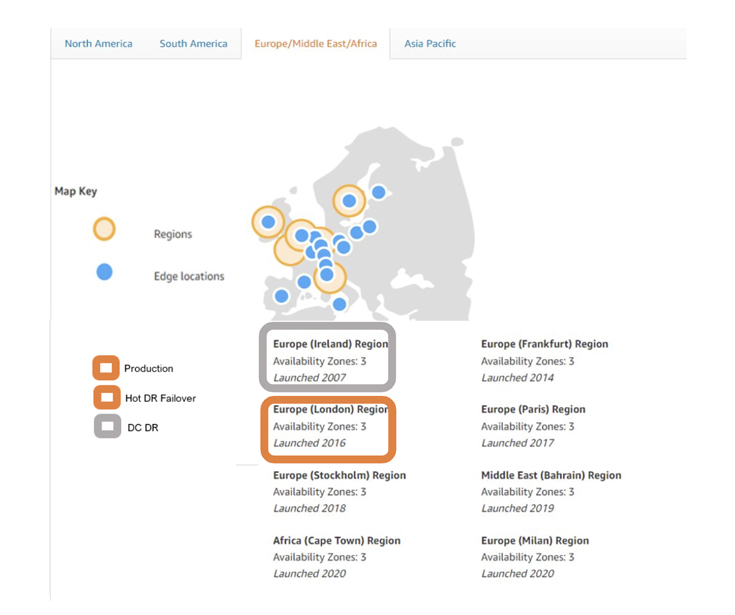

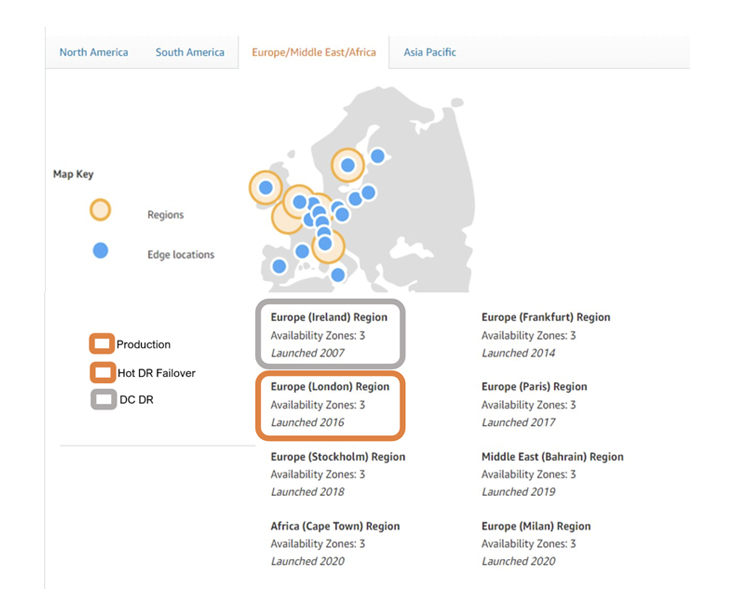

Regional options

Regions

AWS has the concept of a Region, which is a physical location around the world where AWS cluster data centers. AWS calls each group of logical data centers an Availability Zone.

Each AWS Region consists of multiple, isolated, and physically separate AZs within a geographic area. Unlike other cloud providers, who often define a region as a single data center, the multiple AZ design of every AWS Region offers advantages for customers. Each AZ has independent power, cooling, and physical security and is connected via redundant, ultra-low-latency networks. These enable AWS customers such as alignVu, focused on high availability, to deliver even greater fault-tolerance.

AWS infrastructure Regions meet the highest levels of security, compliance, and data protection.

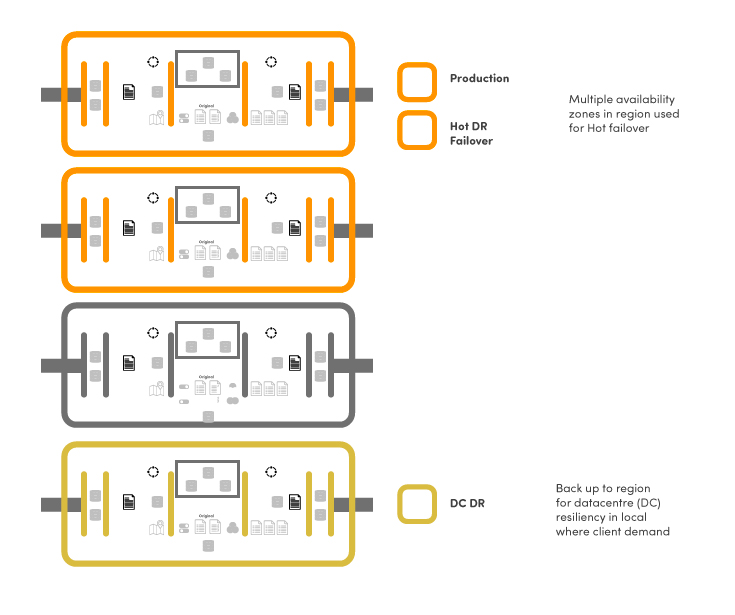

alignVu dedicated AWS

Dedicated AWS Cloud

Enable alignVu to deliver vest in class, high availability, highly secure dedicated services to our clients utilising AWS.

In this we can provide a range of dedicated environments and at various levels of resilience, from mirror production to offline back up and multiple test and UAT/Staging environments where client have chosen an AWS ‘on prem’ solution